What are the dynamics of Artificial Intelligence and Geopolitics?

Jorge Silveira Botelho | BBVA Asset Managment

Head of the BBVA Asset Management business unit in Portugal

With more than 33 years' experience in asset management and capital markets, Jorge Silveira Botelho is responsible for promoting and managing the BBVA Group's asset management business in Portugal.

April 2025 by Jorge Silveira Botelho

We live in complex yet captivating times, where the world is striving to establish a new political and economic order, while artificial intelligence emerges as a revolutionary force in human knowledge.

In the short term, it is increasingly difficult to understand the economic and political strategy of the new U.S. administration, where absurdity seems to prevail, having a paradoxical effect, as the spell appears to have backfired on the sorcerer. The political volatility, marked by its absurdity, objectively disrupts the economic dynamic, as the unclear direction of economic policy erodes expectations and breeds a sense of confusion among economic agents, leaving American exceptionalism in a state of stagnation.

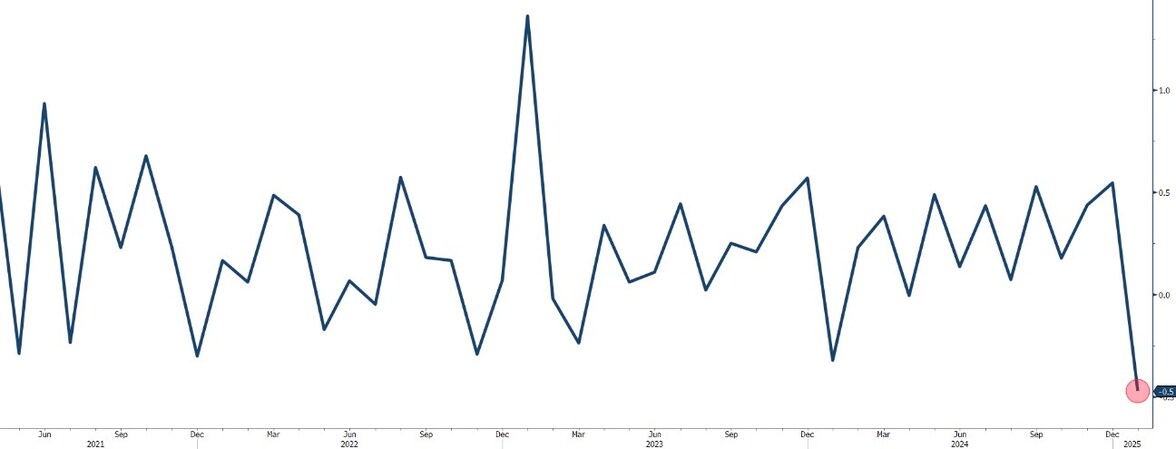

First, the American consumer, who represents 68.8% of the American GDP in 2024 (source: BLS), shows signs of exhaustion and concern. On one hand, we are witnessing a greater weakness in confidence indicators, such as the Conference Board's expectations index, which fell by around 10 points in a month. At the same time, in January, we saw a significant contraction of -0.5% in private consumption and a subsequent rise in the savings rate, from 3.5% in December to 4.6% in January (source: Bloomberg). Additionally, the way public sector employees have been treated, in a largely nominal and numerical manner, does little to restore confidence. All of this occurs without a clear understanding of how to measure the real impact of immigration on economic activity...

USA: Evolution of real monthly consumer spending

Secondly, the lack of transparency and the arbitrary nature of tariff adoption, in addition to undermining relations with traditional trade partners, has a direct impact on many American multinational companies, which face significant difficulties in directing their capital expenditures. Also, the optimism levels of small and medium-sized companies have diminished, as unpredictability

becomes increasingly evident.

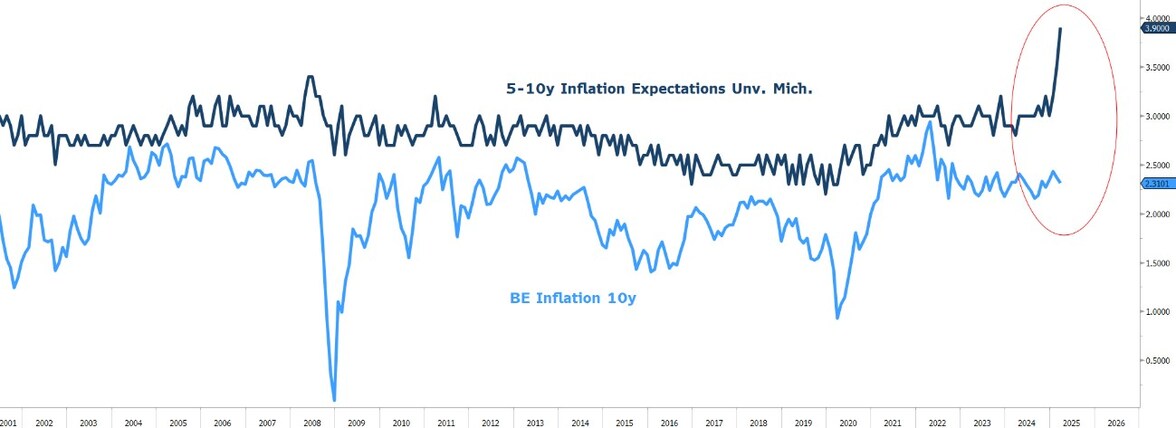

Thirdly, despite the inflation implied in long-term interest rates in the U.S. (BE Inflation) remaining relatively stable, the tariff disputes and the depreciation of the dollar have raised inflation expectations in consumer confidence index surveys. The Federal Reserve itself seems uneasy about revealing too much, but monetary policy remains overly restrictive, and there are risks of a misjudgment between the real inflation risk and the risk of a recession, driven by an exaggerated sentiment regarding inflation.

Differential between the long-term inflation expectations index from the University of Michigan and the implied 10-year inflation rate on the U.S. yield curve

Finally, the misalignment of American foreign policy is making the international order more complex, where predictability can no longer be taken for granted, and unpredictability is the new norm. While it is true that foreign policy has apparently never been a concern for American citizens, a new wave of security and economic and political alliances also necessarily have an impact on internal levels of trust.

However, this situation is unlikely to last indefinitely, as such political disarray tends to provoke internal reactions, and the risks of the economy slipping into a recession caused by the infamous unforced errors are generally more easily avoidable...

Conversely, that very political misalignment in the U.S. has effectively jolted Europe out of a state

of lethargy, decisively contributing to a reshaping of its political and economic strategy. This marks a shift we haven't seen in over a

decade—since 2012, when Mario Draghi famously declared "whatever it takes." Now, that same resolve is being boldly echoed by Germany’s incoming chancellor, Friedrich Merz. It seems that Europe is seeking to find its footing, and the prospect of a ceasefire in Ukraine along with new German leadership could help recover the lost exceptionalism.

Global indices face an issue of excessive concentration in the U.S. market, with the MSCI World Index holding a 73% weighting and the MSCI ACWI,

approximately 66%. %. In both

cases Germany’s weighting is 30 times smaller than that of the United States…

Evolution of the MSCI Word, MSCI ACWI, and DAX indices over the last year (euros)

In this sense and despite all the distrust that emerges from this disorderly but challenging world, there are forces that will not be stopped and that will be much more relevant for the future evolution of economic activity.

When we discuss geopolitics, we must be aware that we live in a totally interconnected and interdependent world, where knowledge sharing occurs at an unprecedented rate. Technology is, in a way, a commodity, and the dynamics of generative artificial intelligence will act as an antivirus, fiercely combating inefficiency and bureaucracy. AI can be a disruptive factor in increasing productivity and reducing context costs, contributing to an even greater structural reduction in government debt. In the private sector, AI will become a driving force behind mergers and acquisitions, and it’s only a matter of time before it begins to assert itself in a much more pervasive and influential way.

Today artificial intelligence is a true revolution in knowledge because it skips steps and gives us time we never imagined we would have. No one seems fully prepared to foresee the potential cross-sector productivity gains that will occur, but these are certainly going to happen—and probably sooner than expected.

Those who do not understand the value of time will likely be swept away by the noise of the ephemeral politics of geopolitics... and consequently will lose the opportunity to let time work in their favor and invest successfully!